Press and News Releases

See why Stamps.com is the leader in mailing and shipping

28

years in business

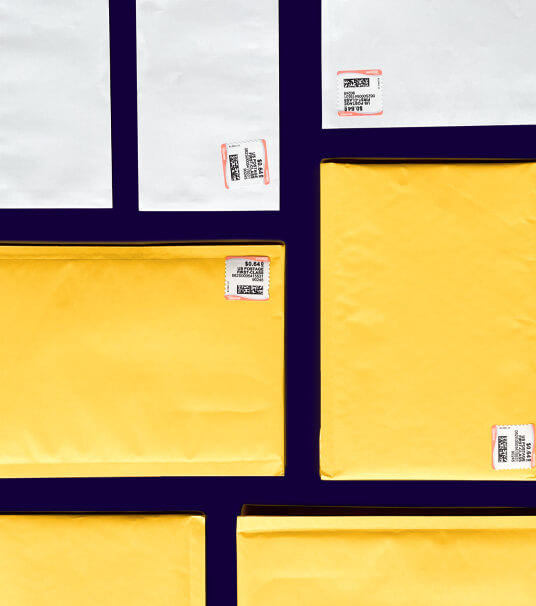

Get up to 87% off postage, schedule free pickups, and print stamps and labels 24/7.