This post is brought to you in partnership with AffiniPay.

Your working hours are precious, so it’s time to put them to good use.

Any task that doesn’t translate into billable hours and happy clients is a time drain. Every wasted minute is a lost opportunity to move the needle forward. But that means you need to know what drains your time and make changes to improve efficiency.

Let’s dive into five common time drains for law firms, and strategies to start working more efficiently.

5 Common Time Drains for Law Firms

Are you losing billable hours without realizing it?

Lost time doesn’t just mean lost revenue. It also affects client trust and employee well-being, and may even damage your firm’s reputation over time. When lawyers are bogged down by admin and inefficient processes, billable hours slip through the cracks, communication slows, and burnout rises. The hidden cost? A less effective, more stressed-out team and frustrated clients.

1. Administrative Inefficiencies

Admin tasks like managing paperwork and scheduling eat up valuable time. Instead of doing what you do best, you and your team of lawyers might be stuck managing logistics and document handling, which cuts into revenue. Now, imagine how much more your firm could achieve if you streamlined these tasks!

2. Manual Time Tracking and Billing

Tracking billable hours can be a struggle, and invoicing often takes way too long. Inconsistent time tracking leads to underbilling and client disputes, which leads to lost revenue. With automation, a digital accounting firm can simplify this, helping you accurately track and bill every minute.

3. Client Intake and Case Onboarding

Redundant data entry and slow onboarding create delays that frustrate clients from the start. This bad first impression can hurt trust and set the wrong tone for the entire case. Streamlining onboarding ensures a smooth, positive start to every client relationship.

4. Inefficient Communication and Its Impact on Firm Culture

Poor communication causes confusion and unnecessary roadblocks. Over time, this means missed deadlines and redundant work. These inefficiencies can create frustration among your staff, which can lead to burnout and high staff turnover. It will also be painfully obvious to your clients that communication isn’t a strong suit, which will impact their experience with you.

5. Managing Non-Core Tasks

When you or your team is managing IT, marketing, or even administrative support on top of their core work, it can become a hindrance. By offloading these responsibilities, you can focus on your core expertise—practicing law.

The Communication Bottleneck: The Hidden Cost of Wasting Time Without Knowing It

Ever feel like your inbox is a never-ending to-do list? Between email overload, missed calls, and back-and-forth scheduling, law firms lose countless hours on inefficient communication. When communication isn’t streamlined, collaboration suffers, and clients feel left in the dark.

Do these time-draining communication challenges sound familiar?

1. Inefficient Communication (Internal and External)

If your lawyers and staff are stuck sorting out confusion instead of making case progress due to old, clunky communication systems, it’s time for an upgrade. Outdated tools make collaboration a pain point and increase the risk of mistakes. In the end, it drags down productivity and slows down the entire client experience.

2. Document Management Struggles

Juggling physical docs and messy digital files causes chaos, wasting time searching for information instead of focusing on cases. Poor storage and version control lead to errors and delays, which make it harder to spot important details. This disrupts workflow and hurts productivity and the overall client experience.

3. Remote or Hybrid Work Schedules

Remote and hybrid work offer flexibility but bring coordination challenges without the right tools. When some or all of your staff work from home several days a week, collaboration can become fragmented, creating communication gaps. The lack of face-to-face interaction makes aligning case strategies harder. Tech issues, like unreliable video calls or trouble accessing shared files, present even more challenges. Inefficiencies grow when your team doesn’t use streamlined systems for case updates and internal communication.

Plugging the Time Drains: Practical Strategies for Law Firms

Here are some strategic ways your law firm can save time and work more efficiently.

1. Automate Repetitive Tasks

Automation tools can help you manage tedious and time-consuming administrative tasks, like:

- Document generation

- Appointment scheduling

- Case and client management

Automating these tasks frees up time for more billable work and reduces human error, streamlining day-to-day operations for greater efficiency.

2. Go Paperless

Replacing stacks of paperwork with a digital document management system helps your law firm:

- Improve document access and security

- Enable quick, searchable records

- Reduce physical clutter in the office

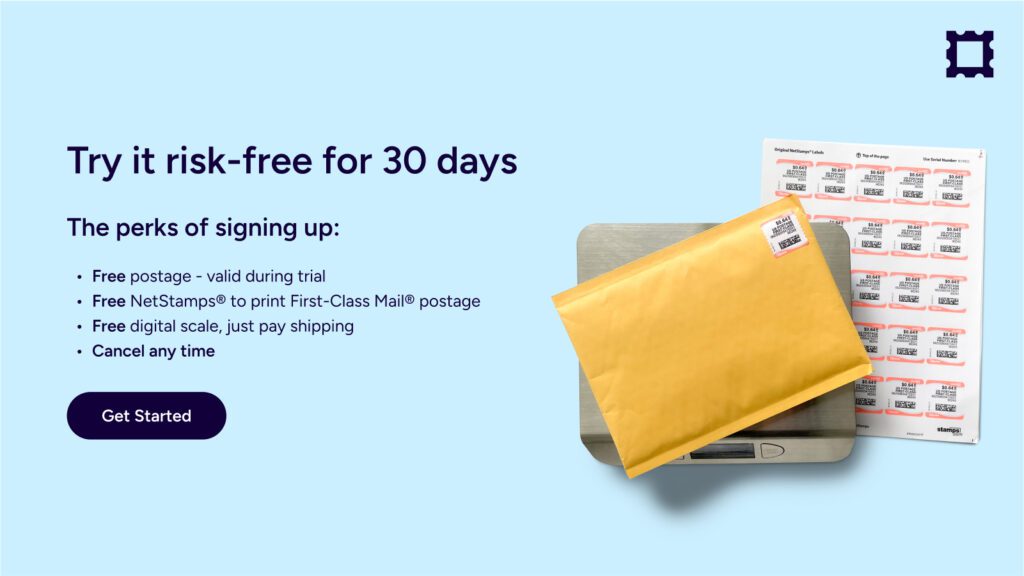

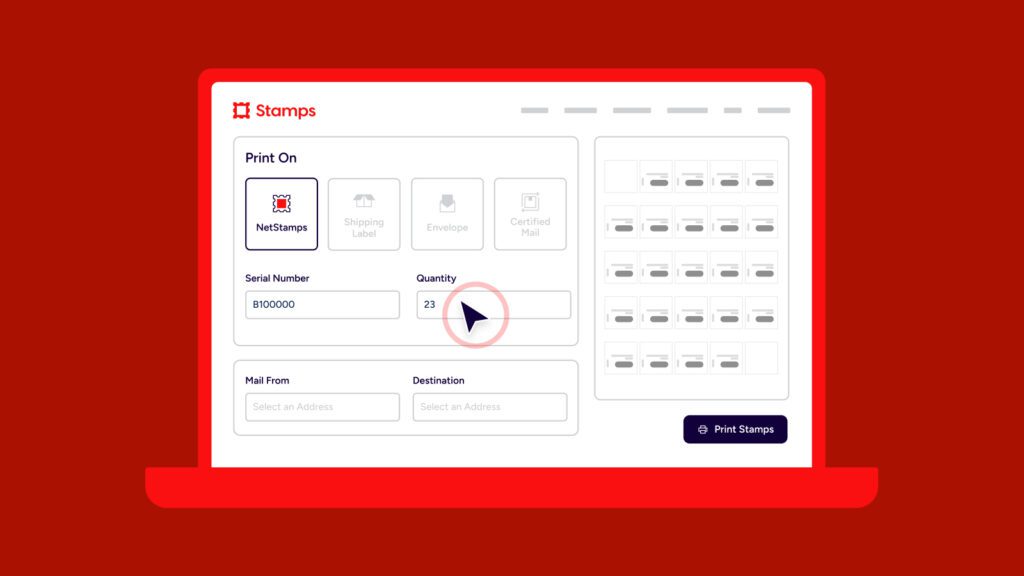

Digital systems boost efficiency in both in-office and remote setups. To meet legal requirements, law firms will always need paper copies for some things. When you need to print and mail legal notices, summons, or contracts, Stamps.com simplifies mailing and shipping to keep your workflow smooth.

3. Improve Time Tracking and Billing Automation

Automated billing software can be a game-changer for your law firm in terms of:

- Tracking time

- Syncing with calendars

- Generating invoices instantly

It saves your attorneys from manually logging time, which is especially important for accurately tracking billable hours. Plus, automated billing speeds up invoicing and minimizes disputes, improving cash flow.

4. Fix Communication Issues

Use tools like Slack, Microsoft Teams, or case management software to:

- Centralize team conversations

- Cut down on email overload

- Improve response times and collaboration

For clients, secure online portals provide instant updates, document sharing, and direct messaging, which reduces the need for check-in emails and builds stronger relationships.

Personalized Client Communication: A Game-Changer for Law Firms

When clients feel like just another case number, they notice. Personalization in communication isn’t just a nice touch—it’s a competitive edge. Client relationship management tools help you make every client feel like the only client by tailoring interactions and automatically sending and receiving updates on time. They also offer an overview so you can track case progress easily.

When you prioritize communication at your law firm, clients get proactive updates instead of constantly chasing attorneys for information. Case details and preferences are easily accessible, reducing the chances of miscommunication. The improved engagement boosts client satisfaction and also helps with higher retention rates.

Measuring Success: Tracking the ROI of Time-Saving Efforts

What gets measured, gets improved. To see if your time-saving strategies are working, you need to track key performance indicators. These can look like:

- Billable hours recovered

- Reduced administrative costs

- Client satisfaction and retention

- Operational cost reductions

As you track these metrics month to month and quarter to quarter, continue to assess and adjust your processes based on the results. What tools are saving you the most time? As you save time in one area, what has become your new biggest time drain? Measuring your ROI and implementing solutions to address time drains on an ongoing basis sets your law firm up for success in the future.

Reclaim Time, Increase Efficiency, and Transform Your Law Firm

Time is one of your firm’s most valuable assets, so don’t waste it on clunky processes and manual tasks. With the right tools, from digital document management to better communication platforms, you can cut the busywork and focus on what actually drives results.

Download Stamps.com’s free ebook, The Digital Law Firm: A Guide on Regaining Flexibility in Your Business Through Digital Transformation, for practical tips, or check out a demo of a top automation tool to see how it all comes together. Less admin, more impact—that’s the goal.