Mail and Ship

USPS® Postage Rate Discounts

See today’s discounted USPS rates at a glance. Compare options, estimate costs, and avoid surprises at checkout.

Get Discounted Postage

Compare Carrier Rates

Compare live carrier rates across services to balance speed, tracking, and cost for every shipment.

Try Our Free Rate Calculator

Compare Carrier Rates

Compare live carrier rates across services to balance speed, tracking, and cost for every shipment.

Try Our Free Rate CalculatorBusiness Solutions

BLOG

The Best Mailing and Shipping Software for Small Businesses

Compare leading mailing and shipping software, learn essential features, and pick the right platform for growth.

Read the Article

BLOG

Business Efficiency Quiz: 10 Signs Your Operations Are Working FOR You

Take our business efficiency quiz to score your operations across 10 key areas. Find out where you're thriving and where you're losing time.

Read the ArticleResources

CUSTOMER STORY

Lewis & Associates Capital Advisors

Learn how Lewis & Associates Capital Advisors eliminated time-consuming trips to the post office by implementing Stamps.com's online mailing solution, saving up to 30% on postage costs while reclaiming valuable hours for client-focused work.

Read Their Story

BLOG

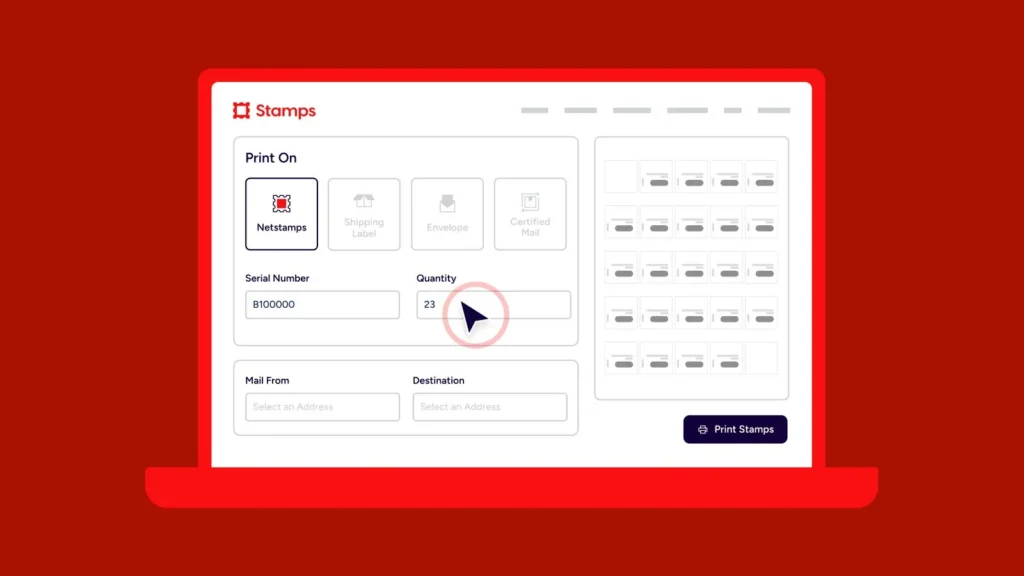

How to Print NetStamps

Step by step guide to printing NetStamps at home, including supplies, setup tips, and common fixes.

Read the Article

BLOG

Winter Storm Delivery Delays: UPS, USPS, and FedEx Updates

Winter storm delivery delays are impacting UPS, USPS, and FedEx. Get service updates and tips to keep your mail moving.

Read the ArticleCompare Rates

RATE CALCULATOR

Compare All Carriers For Your Next Shipment

Stamps.com lets you compare all carrier rates and services all in one place, every time you ship.

Try Our Free Rate Calculator